Obtain news and background information about sealing technology, get in touch with innovative products – subscribe to the free e-mail newsletter.

Up-and-Coming Tiger Cubs

When the first Asian countries began their economic ascent 50 years ago, economists were expecting several Southeast Asian economies to follow suit. But why are they still awaiting their breakthrough? And what does the future hold for them?

Point of Departure

Tigers are quick. They leap very far and very high. And: They live in Asia. When the first Asian countries began growing at a record pace decades ago, the term “tiger economies” quickly came into use. Thanks to a dynamic industrialization process and a strong export orientation, South Korea rose to the status of an industrialized nation within a short period of time. The then-British Crown colony of Hong Kong and the city-state of Singapore have, in the meantime, established themselves as global finance and service centers. Each of the tiger economies has had rapidly rising per capita incomes, following in the footsteps of Japan, the first Far Eastern country to experience an economic miracle of this magnitude.

When economists started to think that more countries – dubbed “tiger cubs” – could be joining the club, they turned their attention to Southeast Asia. Thailand, Vietnam, Indonesia, Malaysia and the Philippines were considered hot prospects due to their economic growth. But the boom was already over by 1997 due to a financial crisis that pulled the rug out from under them. Foreign money had been flowing into these markets in large quantities, triggering a boom in lending. But when Thailand’s real estate market ran into difficulties, the loans could no longer be serviced. Investors lost confidence and withdrew their investments. This situation was compounded by currency speculation that caused the Thai currency to crash. The crisis in Thailand spilled over into other countries. High debt loads, bank failures, corporate bankruptcies and unemployment spread across the region, with International Monetary Fund policies tending to intensify the crisis instead of mitigating it.

The crisis hit Thailand and Indonesia especially hard. Stock market shares collapsed. In just nine months, they lost 50 percent or more in value. The gross domestic product (GDP) in Thailand fell by 13 percent and in Indonesia by 10 percent. Malaysia and the Philippines suffered similar blows. The financial crisis thus destroyed much of the region’s capital. Southeast Asian countries, which were once the beneficiaries of so much hope, were forced to re-evaluate their economic structures and reform their financial sectors.

Key Facts

- Southeast Asia includes 10 countries: Thailand, Vietnam, Malaysia, Indonesia, the Philippines, Cambodia, Laos, Myanmar, the city-state of Singapore, and the Sultanate Brunei Darussalam.

- Today these 10 countries make up the Association of Southeast Asian Nations (ASEAN), which was established in 1967. The organization wants to strengthen political, economic, and cultural cooperation.

- Roughly 9 percent of the world’s population – about 670 million people – live in the region.

- About 11 percent of the world’s foreign investment is flowing into Southeast Asia.

Charting Their Economic Course

The crisis promoted the view that closer regional cooperation was needed. Still, it was only in 2015 that the Association of Southeast Asian Nations (ASEAN) committed to the elimination of nearly all duties on the cross-border transport of goods within the region. At least ASEAN succeeded in forging a free trade agreement with China and India much earlier. Even with the European Union (EU) and ASEAN proclaiming their desire to cooperate more closely in 2022, there still has been no breakthrough. At this point, only Singapore and Vietnam have a free trade agreement with the EU, and only Singapore has one with the United States.

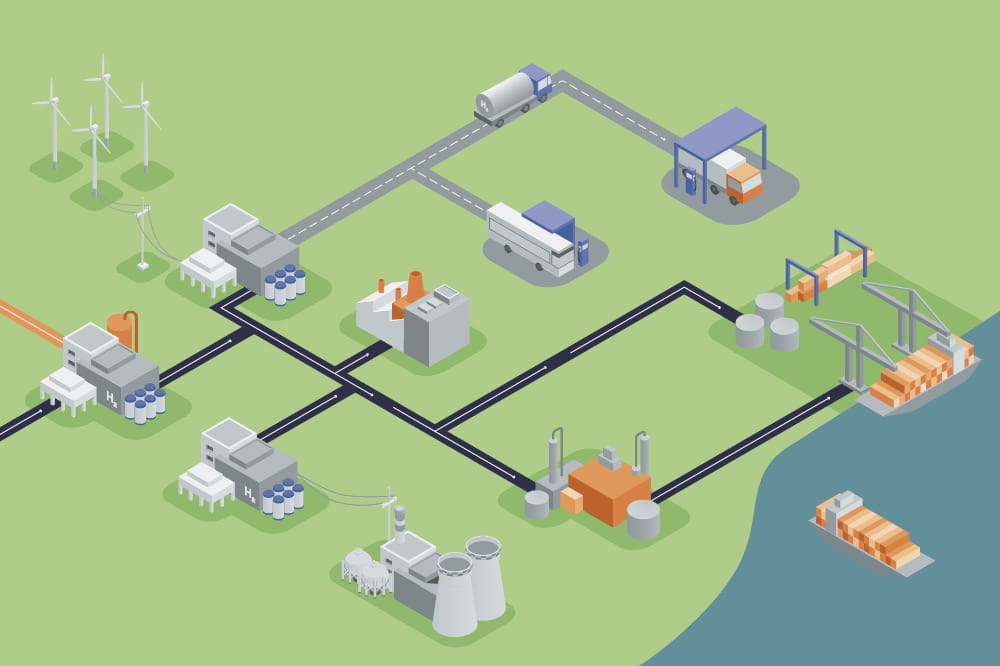

But in 2020, ASEAN stirred the pot. It reached an agreement with China, Japan, South Korea, Australia, and New Zealand on the Regional Comprehensive Economic Partnership (RCEP). The 15 signatory countries want to strengthen their economic cooperation, reduce customs duties, and dismantle trade barriers. If carried out systematically, the accord would create a huge regional market encompassing 30 percent of the world’s population and 30 percent of its gross domestic product. The economic integration of the ASEAN countries would continue. Some experts see RCEP as an opportunity for a more effective division of labor, with greater industrial specialization in the individual countries.

And now? In light of the unforeseeable crises of the last few years, any projections must be viewed with caution – especially with ASEAN’s realization that it is susceptible to natural catastrophes and with climate change posing yet another challenge. The tense relationship between the super powers China and the US could also weigh heavily on Southeast Asia’s economic development. Nonetheless, there is an opportunity for the workshop of the world to migrate to Southeast Asia, at least to some extent. Governments in the region also see the need – as well as the opportunity – to make greater use of technology and digitalization.

Promising Outlook

In any case, RCEP could give Vietnam, Thailand, Malaysia, Indonesia and the Philippines a sustained push to expand their economies, especially as key performance indicators send out positive signals. Based on the 2022 Global Innovation Index, all the tiger cubs, apart from Indonesia, clearly rank in the top half of the 132 countries evaluated. After the pandemic shock, economic growth in the ASEAN zone had already climbed back to 3.4 percent in 2021. The projections for the next few years exceed that percentage. And inflation increased less than in many industrialized Western countries during 2022, when the war in Ukraine began. The share of the population of working age is about 70 percent. Production costs continue to be low, and a growing middle-class promises to breathe life into the domestic economy. All the same, the infrastructure and the level of training could be expanded.

Overall, the positive signs stand out: Thailand is known for its well-developed vehicle and machine-building sector. Vietnam has evolved into an important manufacturing center for textiles, electronics and electrical devices, which has attracted international companies. Auto manufacturing could join them. Indonesia is benefiting from its mineral wealth, which is important for building batteries for electric vehicles. The government is also striving for the digital transformation of its manufacturing sector. Malaysia is also not just relying on its fossil resources – it is producing semiconductors for microchips and wants the status of a high-tech country. The Philippines are positioning themselves as a center for outsourcing services (e.g. call centers, IT and software development), while the government pours money into the large infrastructure projects. It seems the foundation has been laid for the belated pounce of the tiger cubs.

This article originally appeared in ESSENTIAL, Freudenberg Sealing Technologies’ corporate magazine that covers trends, industries and new ideas. To read more stories like this, click here.

More Stories About Sustainability

Join Us!

Experience Freudenberg Sealing Technologies, its products and service offerings in text and videos, network with colleagues and stakeholders, and make valuable business contacts.

Connect on LinkedIn! open_in_new